Specialist Property Conveyancing Lawyers in Costa Brava (Girona)

At PORCEL ADVOCATS, we are a law firm located in Costa Brava (Girona), specializing in property law and conveyancing. We provide personalized and comprehensive legal advice, ensuring professional service at every stage of the buying and selling process. With over 15 years of experience, we are the go-to team for those seeking a close, efficient, and trustworthy approach.

Although we are based in Costa Brava, our services are available for transactions throughout Spain. Additionally, we assist our clients in Spanish, English, and French, ensuring a hassle-free process in your preferred language.

Why Choose Us?

- Experience and Trust: We have been practicing for over 14 years and have solid experience in real estate and international client services.

- Transparency and Honesty: We value honesty in every transaction, working openly and clearly across all our legal services.

- Multilingual Support: We offer understandable legal advice in Spanish, English, and French, so you are fully informed throughout the process.

- Efficient Services: We adapt to new technologies to provide a smoother experience. We are developing digital tools such as guides and videos to facilitate the process without complications.

- Post-Sale Assistance: Our support does not end with the signing. We continue to assist with your tax returns, will drafting, and other property-related services.

Our Property Services

We offer a comprehensive property conveyancing service, both in Costa Brava and throughout Spain, covering a wide range of properties:

- Conveyancing for all types of real estate (residential, commercial, rural, etc.).

- Inheritance procedures (inheritance acceptances, legacies, etc.) and donations.

- Mortgages.

- Residential, commercial, and rural leases.

- Establishment of real rights on real estate.

- New construction declarations/registrations.

- Property registry inscriptions.

- Claims for construction defects.

- Construction contracts and contractual service agreements.

- Preparation of notarial powers of attorney for conveyancing, both nationally and internationally.

- Claims for damages for breach of contract.

- Legal support in company formation or registration of non-resident companies.

- Civil litigation.

- Other services.

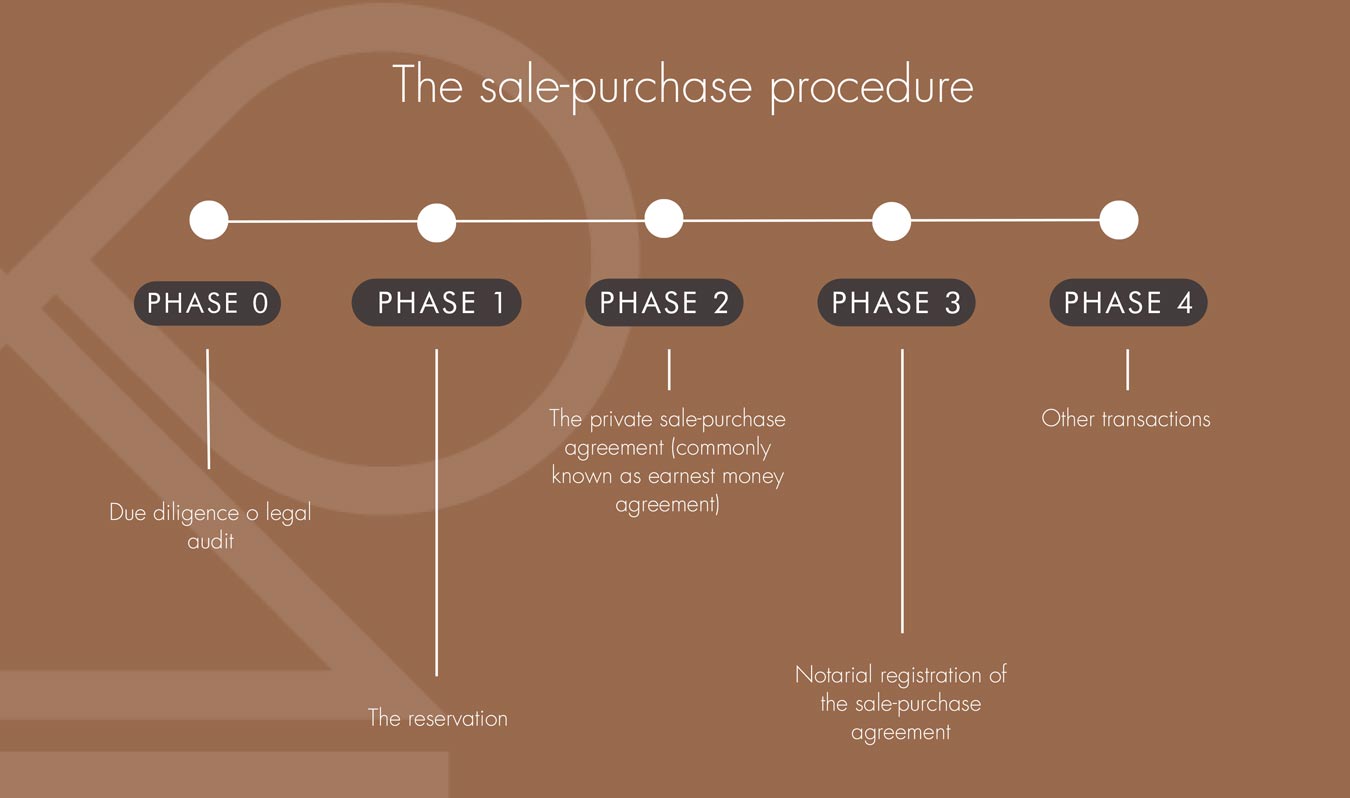

Property Buying Process in Costa Brava (Girona)

Once you decide to purchase a property in Spain and agree on the price with the seller, it is advisable to have an independent lawyer to assist you with the transaction. Our law firm in Costa Brava ensures that the property is legal, there are no hidden charges, and your money is secure until the completion of the purchase.

1. Due Diligence and Legal Documentation Review

After appointing our firm to assist you with the purchase, we will request all necessary documentation from the seller to conduct the relevant legal searches and ensure everything is in order.

Letter of Intent (Reservation Agreement) / Private Purchase Agreement with Deposit

If legal searches confirm that everything is correct, we will request authorization to sign the private purchase agreement. However, you should know that sometimes a reservation agreement (or letter of intent) must be signed first; in other cases, the private purchase agreement is signed directly.

- When signing the reservation agreement, a partial payment is required, usually between €1,000 and €20,000. The range is broad as it depends on your agreements with the seller and the property price.

- When signing the private purchase agreement, a payment of 10-30% of the price as a “deposit” will be required.

2. Legal Report

Once we have all the information and have conducted the relevant legal searches, we will prepare a summary detailing the legal status of the property and the conditions of your purchase transaction.

3. Completion of Purchase

The next step will be signing the purchase deeds before a public notary. At this moment, the remaining balance of the purchase price (and VAT, in the case of new properties) will be paid, and possession of the property will be transferred. From this moment on, you will be the legal owner of the property.

For new properties, our firm will verify that the developer has obtained the relevant licenses (such as the habitability license, first occupation license, etc.) to ensure everything is in order. For second-hand properties, we will ensure there are no debts or encumbrances affecting the property. We will assist you throughout the signing of the deeds.

4. Post-Completion

After signing, you will need to pay the documented legal acts tax (1.5% of the purchase price for new properties) or the property transfer tax (between 8% and 10-11% for second-hand properties).

You will also need to register your deeds at the property registry, complete the registration with the homeowners’ association, register as the new owner for local tax payments (such as IBI and waste tax), and manage utility connections. If you are buying a new property and cannot be present close to completion, it is advisable to designate someone to prepare a snagging list so we can request the developer to address any physical damage to the property. Our firm will assist with all these procedures. Additionally, if you cannot attend the signing in person, we can represent you via a power of attorney that can be prepared both in Spain and abroad, as we have the expertise to draft and help legalize such powers anywhere in the world.

What Do You Need to Buy a Property?

A power of attorney will be required. This power will allow us to sign contracts, pay taxes, manage utilities, and process the NIE on your behalf. We will assist in drafting and signing this power both if you want it formalized at a Spanish notary or any notary worldwide.

When buying a property in Spain, it is important to prepare the following documents and arrangements:

- Foreign Identification Number (NIE): This is the tax identification number needed to pay taxes in Spain. It is essential for notarization but not required for formalizing the reservation or private purchase agreement. Our firm will assist in obtaining these documents.

- Tax Identification Code (CIF): If buying in the name of a company, in addition to the NIEs of each individual, the CIF of the company or legal entity will be needed for notarization.

- Spanish Bank Account: You will need to open a bank account in Spain to handle payments related to the purchase and manage direct debits (homeowners’ association fees, utilities, local and state taxes, etc.).

- Notarized Copy of Your Passport: Required for obtaining the NIE. We will assist with this procedure.

- Proof of Income/Savings: Under anti-money laundering regulations, the bank will require proof of the source of funds. This may include contracts, tax returns, or bank certificates. This is also necessary if you plan to finance the purchase with a mortgage.

- Power of Attorney (POA): To conduct transactions on your behalf

Purchase Costs

The costs associated with buying a property in Spain typically range between 10-12% of the purchase price for second-hand properties and between 13-14% for new properties. These costs include:

New Properties (off-plan)

- Legal Fees: Our fees vary depending on the transaction price. We offer a comprehensive service price, so we recommend contacting us for a no-obligation quote tailored to your needs.

- VAT: The VAT on new properties is 10% of the purchase price.

- Documented Legal Acts Tax (IAJD): 1.5% of the purchase price. This applies when buying a newly built property and for some notarial documents.

- Notarial Fees: Between €500 and €2,000 approximately, depending on the property price.

- Property Registry: Between €350 and €1,200, depending on the property price.

- Utility Connections: Approximately €400.

- Bank Fees: Approximately €300-600.

- Power of Attorney: Between €60 and €250. If the power is legalized abroad, add the costs of the notary in the legalization country plus the costs for obtaining the Hague Apostille. If the country accepts legalizing the document in English or French, there will be no translation costs. If not, we will need to arrange a sworn translation.

Second-Hand Properties

- Property Transfer Tax (ITP): Varies by price and Autonomous Community. For Catalonia, it is 10% up to the first million euros and 11% for amounts over a million euros. Furniture is currently taxed at 5%.

- Notarial Fees: Between €500 and €2,000.

- Property Registry: Between €350 and €900.

- Utility Connections: Approximately €400.

- Bank Fees: Approximately €300-600.

- Power of Attorney: Between €60 and €250.

Annual Costs

After purchase, you should consider the following annual costs:

- Property Tax (IBI): Paid to the local council, varying based on the property’s value.

- Waste Collection Fee: Also paid to the council, though in some municipalities, it may be included in the water bill.

- Homeowners’ Association Fees: Varies based on the services provided by the community (cleaning, maintenance, security, etc.).

- Non-Resident Income Tax: Even if you do not rent out your property, you must pay a tax based on a potential income of 1.1% – 2% of the property’s cadastral value, depending on whether its fiscal value is updated.

- Home Insurance: Cost will also depend on the property’s valuation and the belongings you want to include (generally between €500-2,000).

Our firm will guide you through the entire buying process and manage these annual costs.

Personalized Legal Advice

+15 YEARS EXPERIENCE

SPEED AND EFFICIENCY

HONEST AND RELIABLE

LANGUAGES

AFTER-SALES SERVICE

The Selling Process

You can list your property on the market and try to sell it yourself, or you can be assisted by a real estate agency. Using an agency not only increases the number of interested buyers but also helps you set a reasonable selling price and manage your sale expectations. Real estate agency fees typically range between 4% and 7.5%, plus VAT (21%), depending on the services provided.

1. Pre-Sale Procedures

Before making the sale, you might need to regularize the property. Some of the most commonly requested procedures by our clients include:

- Declarations of new construction.

- Cancellation of mortgages and registration charges.

- Management related to urban charges.

- Procedures for eviction of squatters.

- And more.

2. Legal Searches and Due Diligence

Certain documents and information must be available for the buyer’s lawyers to conduct the necessary legal searches and ensure that the property is legal and free of debts or charges. This is usually required by any buyer before committing to buy and paying any deposit.

3. Letter of Intent or Reservation Agreement / Private Sale Contract

Before working on the sale contract, you may receive a letter of intent or reservation agreement. This document will reserve the property for a period under certain conditions so the buyer’s lawyers can verify the property’s status and prepare a private sale contract.

If the legal searches are satisfactory to the buyer, we will provide the necessary information and organize the signing of the sale contract as agreed with the buyer (in some cases, a reservation agreement is signed first and then a private sale contract; sometimes only the private sale contract is signed).

When the reservation agreement is signed, the buyer will make a partial payment of between €1,000 and €20,000 approximately. Upon signing the private sale contract, the buyer will make another partial payment of between 10% and 30% of the price (subtracting the reservation deposit).

4. Completion of the Sale

The next step will be signing the deeds before a public notary. At that moment, you will receive the balance of the sale price, and possession of the house will be transferred to the buyer.

If the seller is a non-resident in Spain, the buyer will withhold 3% of the sale price and pay it to the Tax Agency within a month after completion. The amount corresponding to the local capital gains tax will also be withheld. This 3% retention serves as a provision to cover the non-resident seller’s capital gains tax. Note that after the sale, you will need to file a tax return to declare the capital gain or loss.

If there is no profit from the sale or if the 3% withheld is more than the tax due, the seller has the right to claim a refund of this 3% (or the excess) from the Tax Agency after completion.

After the sale, the property must be up-to-date with all payments (e.g., community fees, IBI, etc.), and the corresponding certificates must be provided to the buyer. We will ensure these certificates are obtained.

Additionally, if there is a mortgage on the property, it must be canceled simultaneously with the signing of the deeds. We will ensure that the bank representative attends the signing for this purpose, and the buyer will prepare a separate check to settle the mortgage loan, ensuring everything is well-organized.

5. Post-Completion

After the sale, the following procedures are necessary:

- Pay the capital gains tax (Plusvalía).

- File Form 210 for the capital gains tax or claim a refund of the 3% withheld. To claim a refund, a bank certificate with the seller’s account details is needed. The Tax Agency typically takes between 9 and 18 months to process this refund.

- Inform the community administrator of the sale and the new owner’s details.

Our office can help you with all these procedures.

What Documents Are Needed for Selling?

As explained earlier, selling a property requires certain documents for the necessary legal searches. At PORCEL ADVOCATS, we will assist you in obtaining all these documents.

- Copy of your property deeds

- Land Registry note

- Latest IBI and waste tax receipts

- Recent utility bills

- Certificate from the community administrator confirming the property is up-to-date with payments, the cost of community fees, and the payment method

- Community statutes and the latest community minutes

- Energy Performance Certificate (EPC)

- If there is a mortgage, a bank certificate confirming the mortgage balance

- Seller’s NIE number

- Power of attorney: granted to your lawyers so they can handle the necessary procedures on your behalf

- First Occupation License / Habitability License

- To claim a refund of the 3%, a bank certificate with the seller’s account details

- If the property is sold furnished, an inventory of the furniture

- If the seller is a tax resident in Spain but not Spanish, a tax residency certificate to avoid the 3% withholding.

- In some cases, additional documents may be required (e.g., if the seller is a company).

Selling Costs

When selling a property, the seller should consider the following costs (additionally, it is crucial that the property is sold free of charges and up-to-date with all payments, so if there are any outstanding debts, the seller must ensure these are settled).

- Legal Fees: Our fees vary depending on the transaction price. We offer a comprehensive service price, so we recommend contacting us for a no-obligation quote tailored to your needs.

- Mortgage Cancellation Costs: Notary and Land Registry fees for canceling the mortgage typically range between €400 and €600.

- Real Estate Agency Commission: Between 4% and 7.5% of the sale price, plus VAT (21%).

- Capital Gains Tax: This tax is 19% on the net profit. If there is no profit, a refund of the 3% withheld can be claimed. Confirm these details with our advisors as updates may be needed.

- Plusvalía Tax: This local tax varies based on the property’s cadastral value and the length of time the seller has owned the property.

- Energy Performance Certificate (EPC): The cost of this document ranges between €80 and €250.

- Bank Fees: Approximately between €300 and €600.

- Power of Attorney: Between €60 and €250. If the power is legalized abroad, add the notary fees in the legalization country plus the costs for obtaining the Hague Apostille. If the country accepts legalizing the document in English or French, no translation costs will be needed. If not, sworn translation will be required.

- Other Expenses: It is advisable to budget for additional amounts to cover minor expenses and potential contingencies (e.g., community certificates, Land Registry certificates, etc.).

Main real estate practice areas of Porcel Advocats

Southern Costa Brava

Blanes and surroundings

- Blanes

- Malgrat de Mar

- Blanes Beach

- Sa Palomera

- Santa Susanna

Lloret de Mar and nearby areas

- Boadella Cove

- Canyelles Cove

- Giverola Cove

- Pola Cove

- Lloret de Mar

- Fenals Beach

- Lloret Beach

- Sa Caleta Beach

- Tossa de Mar

- Old Town (Vila Vella)

Palafrugell and surroundings

Begur and surroundings

- Begur

- Palau-sator

- Pals

- Aiguablava Beach

- Pals Beach

- Sa Riera Beach

- Torroella de Montgrí

- L’Estartit Beach

Palafrugell and its coves

- Calella de Palafrugell

- Canadell Beach

- Port Bo Beach

- Llafranc

- Llafranc Beach

- Palafrugell

- Tamariu

- Tamariu Beach

Sant Feliu de Guíxols and Palamós

- Palamós

- La Fosca Beach

- Palamós Beach

- Sant Feliu Beach

- Sant Pol Beach

- Sant Feliu de Guíxols

Northern Costa Brava

Cadaqués and Cap de Creus

- Cadaqués

- Joncols Cove

- Nans Cove

- Llançà

- Cadaqués Beach

- Llançà Beach

- Port Beach

- Port de la Selva Beach

- Port de la Selva

L’Escala and Empuriabrava

- Canals and marina

- Empuriabrava

- L’Escala

- Els Molins Beach

- Empuriabrava Beach

- Riells Beach

Roses and surroundings

- Palau-saverdera

- Canyelles Petites Beach

- Roses Beach

- Puig Rom

- Roses

- Santa Margarida

Sant Pere Pescador and Fluvià area

- Sant Pere Pescador Beach

- Sant Pere Pescador

Additional northern area

- Colera

- Colera Beach

The information provided on this website is general, indicative, and approximate in nature, and should not be considered personalized legal advice for specific cases. While we make every effort to ensure that the content is up-to-date and accurate, PORCEL ADVOCATS S.L.P. accepts no responsibility for errors, omissions, or misinterpretations that may arise from the use of this information.

Using the information on this website does not create a lawyer-client relationship, and it is highly recommended that you consult an attorney to receive legal advice tailored to your specific circumstances.

PORCEL ADVOCATS S.L.P. disclaims any legal responsibility arising from the use or interpretation of the information provided here, including, without limitation, any direct or indirect loss or damage that may result from the use of the information on this site.